social security tax definition

Often Social Security Abbr. Government on both the employee and the employer.

What Is The Standard Deduction Tax Policy Center

Social Security wages are those earnings that are subject to the Social Security portion of the FICA tax.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

. Social Security functions much like a flat tax. The social security program is funded through a federal tax levied on employers and employees equally. Ad Know the impact Social Security will have on your taxes when combined with other income.

Employers must withhold Social Security and Medicare taxes from wages paid to both hourly and salaried employees. A tax rate is a measurement used to calculate the amount of tax an individual or corporation pays. FICA Tax Limits.

Know the impact of collecting Social Security early vs waiting until full retirement age. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. More than 34000 up to 85 percent of your benefits may be taxable.

The Social Security tax is levied by the US. Social Security is a federal program that issues benefits to retirees and disabled workers based on their age and work history as well as to beneficiaries family members and survivors if they meet certain eligibility requirements. As of 2020 the Social Security tax is 62 percent of wages up to the first 137700 of earnings.

Between 32000 and 44000 you may have to pay. Social Security is funded through a payroll tax that is separate and independent from income tax. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

The simplest answer is yes. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. First recapture taxes penalties and other taxes related to retirement plans to the underpayment of estimated tax to uncollected employee social security tax on tips and on group-term life insurance and to excess golden parachute payments and exempt organizations excise taxes are added.

Social Security Tax synonyms Social Security Tax pronunciation Social Security Tax translation English dictionary definition of Social Security Tax. Married filing jointly with 32000 to 44000 income. Overpayment of Social Security or Supplemental Security Income SSI benefits Excess earnings Voluntary income tax withholding Payment of your appointed representative.

In fact the formal name of the program is the Old Age and Survivors and Disability Insurance and may appear on a paystub as OASDI. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Between 25000 and 34000 you may have to pay income tax on up to 50 percent of your benefits.

These two taxes are collectively known as Federal Insurance Contributions. In 2022 the Social Security portion of FICA excluding Medicare to be withheld from the first 147000 of each employees annual salary or wages is 62. The Social Security wage base is set at 147000 in 2022.

If you have other sources of retirement income such as a 401k or a part-time job then you should expect to pay income taxes on your Social Security benefits. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Currently the Social Security rate is 124 split evenly by the employer and employee.

Definition and Examples of Social Security Wages. Money collected from employers and employees by the government to pay people when they retire or. Information about social security tax in.

Social Security is funded by a special 124 tax paid by employers employees and self-employed individuals. Social security tax meaning. This means that youll pay the Social Security tax on 62 on your earnings up to 147000.

Married filing separately and lived apart from their spouse for all of 2019 with 25000 to 34000 income. Social Security income is generally taxable at the federal level though whether or not you have to pay taxes on your Social Security benefits depends on your income level. W E Snelling Dictionary of income tax and sur-tax practice incorporating the provisions of the Income tax act 1918 and the Finance acts 1919 to 1930 for the use of professional and business men accountants etc.

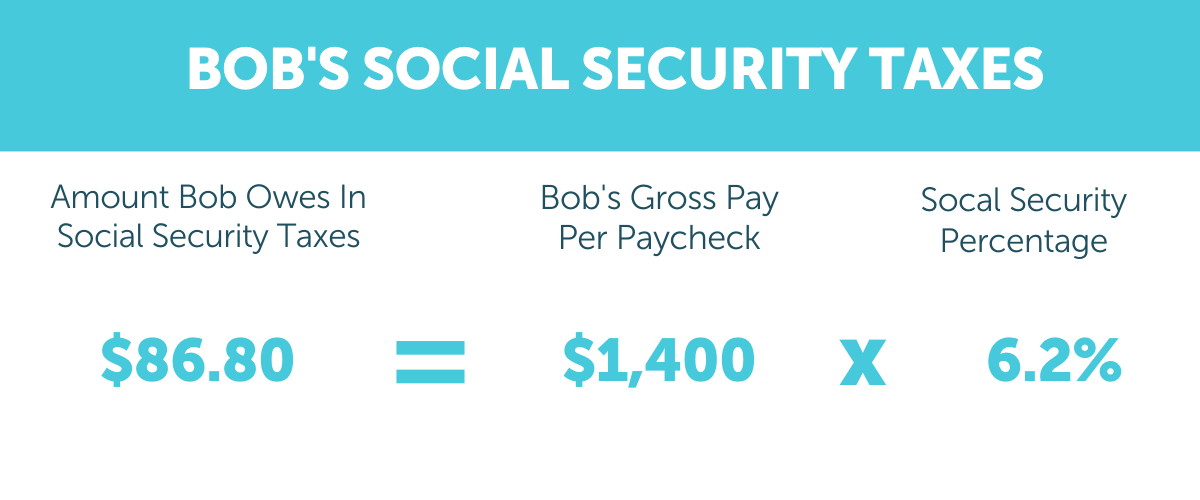

The federal government can also garnish benefits under the following circumstances. Fifty percent of a taxpayers benefits may be taxable if they are. The standard OASDI tax rate for withholdings for employees is 62 So you will see 62 of each paycheck withheld for Social Security tax.

A broader definition of social insurance includes both those tax-supported programs such as Social Security and other programs including income tax credits designed to provide income support help people secure or afford necessities such as food housing and health-care coverage and provide benefits or services to improve economic opportunities such. In addition to the employees tax your employer is also required to pay 62 of your gross income into the system. Half this tax is paid by the employee through payroll.

Everyone pays the same rate regardless of how much they earn until they hit the ceiling. An additional tax of 29 pays for Medicare and Medicaid benefits so the total tax rate is 153. 301 et seq to provide old age survivors and disability insurance benefits to the workers of the United States and their families.

SS A government program that provides economic assistance to persons faced with unemployment disability or agedness. Self-employed taxpayers must pay the whole rate as both employer and employee but may deduct half of that amount when filing income taxes. Excess social security taxes and the earned income credit EIC that is used to.

London New York Sir I. Your wages above that limit. The Social Security Program was created by the Social Security Act of 1935 42 USCA.

Note that this amount is entirely separate from the amount of income tax that you will owe to the IRS. In addition the employer incurs Social Security expense of 62 and as a result must remit.

Pension Vs Social Security Key Differences

Heritage Explains The State Of Social Security

Here S Every State S Average Social Security Check For 2020

:max_bytes(150000):strip_icc()/GettyImages-485008004-0fc1bd9ac96844daa818ab6b90fff5bf.jpg)

Who Is Exempt From Paying Into Social Security

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Form 1040 Sr U S Tax Return For Seniors Definition

What Are Payroll Taxes And Who Pays Them Tax Foundation

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)

Social Security Tax Definition

How Does Social Security Work The Motley Fool

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/GettyImages-184127461-e960f1b3d8964e9ca317e4640e208ab2.jpg)

Social Security Tax Definition

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

:max_bytes(150000):strip_icc()/GettyImages-172770509-b6197b1c0b664655a1c9689c22024852-bca1bcbcd0e3458f87bbe700444c5a21.jpg)

The Purpose Of Having A Social Security Number

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Repeal Prwora Project Travesty Of Social Security Act Of 1935

Understanding Your W 2 Controller S Office

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities